State of the Horse Industry After Covid-19

There’s no doubt that Covid-19 has changed the world. In this report, you’ll learn how the pandemic has affected the horse industry.

In this report, you’ll discover…

- How the global supply shortage has increased horse trailer prices – and how long it’s predicted to continue,

- The COVID-19 rebound effect – and its impact on the horse industry,

- The horse racing industry’s struggle to recover after rescheduling the Triple Crown in 2020,

- Online horse purchases – and how this new trend is changing the way people buy horses,

- COVID-19’s effect on local, national and international horse competitions across the world.

The pandemic caused drastic changes in the lives of thousands of horse owners across the globe. Competition horse owners missed scheduled events that were cancelled because of the pandemic, leisure horse owners were unable to travel because of COVID-19 restrictions, and equine business owners faced product shortages and higher material costs. Uncertainty, doubt, and fear have entered the minds of almost all Americans, as they wonder what the economic future will hold.

The pandemic caused drastic changes in the lives of thousands of horse owners across the globe. Competition horse owners missed scheduled events that were cancelled because of the pandemic, leisure horse owners were unable to travel because of COVID-19 restrictions, and equine business owners faced product shortages and higher material costs. Uncertainty, doubt, and fear have entered the minds of almost all Americans, as they wonder what the economic future will hold.

In this past year full of changes and uncertainty, many business people and horse owners have asked the question: “how has COVID-19 impacted the horse industry?” With hundreds of cancelled equine events and horse auctions, those involved in the equine industry are wondering if things will go back to normal, or if the future of the horse industry will be much different than the past.

This State of the Horse Industry Report will discuss how the pandemic has affected the equine industry both as a whole and on an individual level. We will outline the major changes that have taken place regarding horse businesses, events, and purchases while providing an overall outlook for the future of the equine industry. While it’s always difficult to predict future economic trends and know exactly what the horse industry will be like in the future, the horse industry has been a strong force in the past and has a positive outlook for the future.

Brad Heath, Double D Trailers founder explains impacts of the COVID-19 virus and pandemic on the horse industry as a whole.

How Much is the US Equine Industry Worth Today?

During the past five years before the pandemic, the equine industry has grown at a slow but steady rate. According to the IBIS World Report, the average industry growth from 2015-2020 was -3.4% (1). However, the downward trend in annual revenue is due to 2020’s reported revenue, which was dramatically decreased because of the COVID-19 outbreak.

The report states that because “per capita disposable income declined for the first time in over a decade,” consumers were more worried about buying products, including horses and other equine goods. This lack of consumer confidence, along with the cancellation of many equine events, put a damper on the growth of the industry during the last year.

The second largest portion of the market size, 32% to be exact, came from the competition sector, which was worth $28.3 billion dollars. Major sources of revenue in the competition sector include both English and Western competitive riding events, travel to and from the events, and lodging at the event locations.

The recreation sector followed closely behind, at $18 billion dollars. For both the competition and the recreation sector combined, there are a total of 7 million potential customers, two million of those potential customers own horses, and 5 million do not (2). Overall, leading up to the pandemic, the US Equine Industry appeared to be fairly stable, based on number of competitions attended and horse owner purchases.

However, in the wake of the COVID-19 pandemic, the horse industry – especially for the competition and racing sectors – has taken a hit, and revenues have dropped dramatically. This has affected horse owners individually and the horse industry as a whole.

How Has COVID-19 Impacted Horse Owners Specifically?

In the US alone, there are around 9.2 million horses, and two million horse owners. The average horse owner owns four horses and usually spends around 22 hours a week with their horse. In terms of spending habits and horse maintenance, the average horse owner spends at least $7,200 on horse care annually (the majority of those costs coming from veterinary care) (2).

Individually, all types of horse owners have experienced stability in horse ownership throughout the pandemic. In a recent survey done by American Horse Publications, researchers found that despite the worldwide changes in business and lifestyle, there has been an overall stability in the US equine industry, at least on an individual level (4).

The survey included responses from more than 7,267 horse owners and managers, and 75% of them reported that “the number of horses they currently own or manage is the same as in 2020” and 10.4% of them own or manage more horses this year than last year. Researchers concluded that “comparing this to the 2018 survey, we see an increase in expected stability regarding the number of horses owned/managed” (4).

In terms of competition horse owners, the survey showed that generally, horse owner participation in competitions has decreased dramatically. In 2018, only 38.7% of horse owners didn’t plan to compete, while this year researchers found that “more than 45% of the respondents do not plan on competing at all in 2021” (4).

Many horse owners, both competition and recreational, also noted that they have spent less time with their horses. One study showed that 28% of horse owners reduced their riding – because of their own personal choices or because of restrictions from communities or organizations (5).

Although some horse owners weren’t able to visit their horses as much as they hoped or compete in their usual riding or racing competitions because of the pandemic, overall, on an individual level, the future of the equine industry seems to point towards stability in the future.

Results of the Pandemic: Hundreds of Cancelled Equine Events

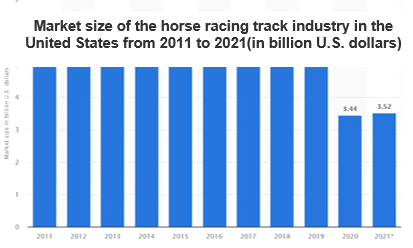

The year before the pandemic, the racing sector added $15.6 billion to the US economy, due to wagering and betting at horse races (6). In 2020, that number decreased, as major events like the Kentucky Derby and all three triple crown races – some of the racings sector’s biggest money-makers – were held without spectators (7). Specifically, the Kentucky Derby had a $124.9 million drop off, and 2020’s overall wagering on horse races was slightly lower than 2019’s.

Compared to 2019, last year’s revenue for the racing sector of the horse economy was significantly lower. Overall, purses at horse races in 2020 were 25.5% lower than the previous year, and there were 23.5% fewer horse racing events (8). However, average wagering per race day increased by 32.6%, compared to 2019, so it’s very likely that the horse race sector will quickly bounce back as horse races resume their normal schedules.

Horse races weren’t the only equine events cancelled in 2020. The competition sector also suffered a major blow as many horses shows and English and Western competition events were cancelled or postponed. Events like these can have major impacts on not just the equine industry as a whole, but also state economies, as local competition events can bring in large amounts of revenue for the city as a whole.

So, when equine events had to be cancelled because of the pandemic, it wasn’t just the horse owners individually who missed out – communities and entire states suffered great economic losses. When these competition events start up again, they will boost local economies and increase the revenue and strength of the equine industry as a whole.

Are People Still Buying Horses?

The pandemic caused an overall decrease in household revenue for the grand majority of Americans. This decrease in income led to fewer purchases, especially luxury or leisure purchases. Consumer spending collapsed during the early months of 2020, causing horse sellers, along with other business professionals, to change the way they did business.

Before the pandemic, most people would never even think about buying a horse without first riding it and seeing it in person. However, COVID restrictions made people think twice about the “norms” of buying and selling. The horse market specifically saw drastic changes.

Courtney Cooper from Chronicle of the Horse reported that during 2020, as part of their new sales process, they sent out hundreds of videos to potential customers who were interested in their horses. Because travel and in-person contact were restricted, people who were interested in buying horses watched videos of the horses they wanted, instead of seeing them in person. Businesses like Chronicle of the Horse adapted to work with people in new ways, but the main sales principles still ring true – “the horses have to sell themselves, and the people—both buyers and sellers—have to be happy” (11).

However, the decline was not as drastic as some economists predicted. Overall, “in North American Thoroughbred auction markets in 2020, average prices for weanlings were down 6.2%, yearlings were down 20.3%, 2-year-olds in training were down 26.7% and broodmares were down 1.7%.” (12).

Premier Horse Sales, a horse auction company that does over one hundred auctions across the country every year, was one of the many horse auction companies that has experienced a quick bounce-back after decreased sales in 2020. In 2020, their online auction in Reno, Nevada, their average sale was $19,170, while for their in-person auction in 2021, their average sale was $37,040. The same happened in their Fort Worth, TX sales, where 2021’s average sale was $12,385 more than 2020’s (13). This shows a positive trend for the coming years regarding horse sales and purchases.

Although this year’s in-person horse sales have generally been more profitable than last years, online auctions have been extremely successful, especially when taking into consideration just how different it is to buy a horse online compared to seeing it in person.

Horse Auctions Move Online

One of the biggest changes that the horse industry has seen because of the pandemic has been an increase of online sales – of horses, trailers and transportation vehicles, horse tack, and more. When the pandemic caused horse auctions to go online for the first time in history – horse prices took a hit.

But, since the beginning of 2020, there’s been a huge increase in the number of online bidders – all because of the pandemic. According to one New York Times article, “at this same [Keeneland] sale in 2020, online buyers spent $12.1 million. This year, buyers spent $15.7 million online in just the first six days” (14). That’s a remarkable increase in sales – especially for the online market.

And, horse owners are getting more and more used to buying horses online. When horse auctions first moved online, “many had agents assess the horses in person before buying” (14). But, as the online process has become normalized, this year many have bought horses online without a second thought. That’s a drastic change, especially when considering that buying a racehorse is a high-risk high-reward type of purchase. But with the huge boom in online purchases, consumers have gotten used to even buying horses online.

Shannon Bishop Arvin, CEO of Keeneland, said that the demand for race-horses has increased, and more diverse buyers have entered the market – “there’s such a pent-up demand for racehorses,” and that demand is likely to continue into the future (14). She also noted that “Covid has desensitized us to online buying, where we used to be more compelled to be there in person,” something that for Keeneland, has earned them huge profits, even during the pandemic.

Will online horse auctions continue in the future? It’s very likely. The ease of buying a horse from your living room on your laptop will open the doors to more buyers and more opportunities for horse vendors as well.

2020: The Year of Online Purchases

Relating this then to the equine market, we note the same decreases and increases – fewer competition and equine events, and thus less leisure travel (whether for recreation or equine tourism) and greater online purchases and virtual equine events (like veterinary appointments and virtual equine activities). The study showed that “e-grocery shopping, virtual healthcare visits, and home nesting were likely to stick while remote learning, declining leisure air travel, and decreasing live entertainment would likely revert closer to pre-pandemic patterns” (15).

This is good news for the horse industry for many reasons. First, the revamp of leisure travel and equine events will boost the horse industry back to pre-pandemic rates – more competitions will mean more travel and more income for the industry and the communities and states where the events take place. Second, the continuance of home nesting will perhaps lead to more equine products designed for the home and barn, and a greater consumer desire and willingness to purchase those items. This could open up new product markets and opportunities for horse business owners to design products and services with home nesting in mind.

Finally, the prevalence of online shopping will facilitate consumer spending and lead to more and more online purchases. Companies that have transitioned their products and services and made them available online will be able to better recover and continue to grow financially as more and more consumers spend their money online.

The Horse Trailer Market

The year before the pandemic, specialized and niche trailer segments, like horse trailers and livestock trailers, were expected to show “low single-digit growth rates” (16). Usually, the horse trailer market aligns closely with the agricultural and equine markets, experiencing similar ups and downs in the market. However, in the horse trailer market, the pandemic has caused some different market behaviors.

Before the pandemic, if you wanted to buy a trailer, you would probably head to a trailer dealer lot to check out the options, models and styles available for you to choose from. You’d talk with a salesperson and look around inside the trailer you were thinking of buying.

But, with the pandemic, people started staying home – many people were hesitant to head to a dealer and have an in-person interaction. And like we mentioned before, people became more and more used to buying things online – yes, even huge thousand-dollar horse trailers.

The horse trailer companies that already had online purchasing options set up were at a big advantage compared with their competitors. Double D Trailers, a trailer company with a 100% online business model, reported that this year was their best sales year in company history.

Like many trailer companies, before the pandemic, sales were increasing and things were looking good. For Double D Trailers, before the pandemic, from 2018 to 2019, there was a 40% increase in sales. Many companies were worried that when the pandemic struck, sales would plummet. However, the companies that were able to transition to an online sales model, or those that already had one in place, were able to continue to see growth throughout 2020 and this year. For Double D Trailers, there was still a 12% increase during last year, and Brad predicts a 14% increase for this year.

For the horse trailer industry as a whole, demand is still strong, although trailer pricing has drastically increased because of material shortages, delivery driver shortages, and production bottlenecks across the industry. It’s likely that after the peak in sales during the pandemic, sales will start returning to pre-pandemic levels. Once factories and companies fulfill their backlogs of trailer orders, their inventory will return to normal, and demand will likely decrease.

However, although the horse trailer industry seems to be heading for a cooling off period, it’s likely that in the future, more and more people will turn to buying horse trailers online. Companies that offer online purchasing options and facilitate the online process will be a step ahead of the competition in the years to come.

How the Global Supply Shortage Has Influenced the Horse Industry

One of the biggest overall economic effects of the pandemic was the disruption of the global supply chain. When COIVD-19 hit, factories in many parts of the world shut down or decreased production because of lockdowns and shortage of workers. This caused a shortage of products – goods that people did in fact, want and need during the pandemic.

As businesses saw this increase in demand – especially for household items and goods – they pressured factories to keep up with production, but because our world is so interconnected, when companies couldn’t get certain parts (like shipping containers, electric panels, and other items), a huge order backlog began.

Double D Trailers, for example, even though they’ve had record sales during the pandemic, currently has extended wait times because of the backlog and shortages. Their factory is rolling at mass production, but material shortages are rampant and prices on raw goods continue to increase dramatically. With driver shortages and the increased cost of shipping, they are experiencing longer and longer wait times.

Brad says that “even if we can increase sales, right now, the bottleneck is production and getting trailers built. We are at max capacity and labor shortages are preventing any additional production.” This makes for a difficult business environment for many companies, and it will likely continue into the next year as inflation increases and the global supply shortage slowly resolves over the next 24 months.

The Rebound Effect of COVID-19

Even though there are significant set-backs in production and delivery because of the global supply chain, consumers today are ready to spend. Since many Americans had to cut back on spending because of travel restrictions and lockdowns, much of that money that would have been spent on trips or dining in restaurants has gone straight into savings.

According to one McKinsey report, there was a “massive ten- to 20-percentage-point spike in the savings rate across the United States” (15). One Deloitte report even estimated that as a whole, “consumers saved about US$1.6 trillion more than what they would have saved had there been no pandemic” (17). This savings increase means that many consumers are in a strong position to spend more in the coming years. It’s likely that with the end of the pandemic, consumer spending will return to pre-pandemic levels, especially since many Americans have more money to spend than before.

During the pandemic, purchases of products and goods increased and businesses selling durable and nondurable goods benefitted greatly. At the same time, spending on services decreased dramatically, and many businesses had to shut down because there just weren’t enough customers.

For the horse industry, this means that spending on services and events will slowly return to pre-pandemic levels as many people are anxious to return to travel, competition, and horse racing events. As for goods purchases, like tack and equipment, it’s likely that these types of purchases will slow down and return to normal as well.

Overall Outlook for the Future of the Horse Industry

Despite the economic setbacks that the COVID-19 pandemic has caused for the horse industry as a whole, there are many positive factors that will affect the market in the coming years. With seven million potential customers in the recreation and competition sectors combined, there’s a huge opportunity for growth and progress in the horse industry (2).

In the coming years, not only will the horse industry see a “rise in association membership, gaining popularity in worldwide competitions, and companies partnering with non-profit groups,” but there will also be a strong and positive return to in-person events that will revamp and increase profits across the industry (2). The pandemic has shown us our need for community and togetherness, and this will likely contribute to more people becoming part of equestrian organizations to feel that sense of community, shared interests, and unity.

The changes in spending habits and the familiarity with online spending – even for large purchases like trailers and racing horses – will continue to benefit not just those sectors, but also goods and services as more and more horse owners turn to online purchases. Although it is likely that purchases of tack products like saddles, stirrups, bridles and other equipment items will decrease slightly, as equipment sellers and manufactures continue online sales tactics and make the online purchasing process easier, more consumers will continue to purchase online. The shift to online purchases is here to stay.

Based on the number of horses owned, the equine industry has seen stability throughout the pandemic and is predicted to see stability into the future. The majority of horse owners report that this year, they own the same number of horses that they did in 2020, and more than 10% reported owning more horses this year than last. Increasing horse ownership means a greater demand for equine goods and services and a greater participation in equine events as well.

Overall, the future of the horse industry appears promising. Although the global supply chain problem will continue in the coming years, both consumers and businesses will adapt and adjust to those changes. Quality of horses will continue to be the number one factor driving horse purchases, and with the return to live equine events, the horse industry is likely to see positive growth in the coming year.

If you’re like many horse owners that are anxious to get back to competitions and leisure travel with your horse, now is a great time to build a beautiful custom trailer online. From the comfort of your living room, you can pick and choose which features are the most important for you and your horse, so you can splurge – or save – in creating your perfect horse trailer. With Double D Trailers, everything is factory direct, meaning you’ll be able to save money while getting all the features you want.

A trailer is a long-term investment, and now is the perfect time to create your custom trailer. When you place an order with Double D Trailers now, you’ll be sure to get it in time for when the horse industry has rebounded completely. Check out our custom-built horse trailers today to get your trailer in time to travel to your first post-pandemic equine event or competition. Reach out to Brad Heath if you have any questions about creating your perfect horse trailer.

Sources:

- IBISWorld's Analysis of the Horse Industry

- 2019 Equestrian Market Analysis

- Graph - Market size of the horse racing track industry in the United States from 2011 to 2021(in billion U.S. dollars)

- 2021 AHP Equine Industry Survey Results

- Survey Results on Effect of COVID-19 on Horse Industry

- The Economic Impact of the Horse Industry

- Purses Fall Sharply from 2020 to 2019

- The Economic Contribution of Equine Events in Vermont

- Effects of the COVID Shutdown

- Will COVID-19 Change Horse Sales

- Short- and Long-term Effects of COVID-19 Restrictions on Equine Markets

- Sales Results for 2020 and 2021 Auctions

- Pandemic Changes the World of Horse Auctions

- The consumer demand recovery and lasting effects of COVID-19

- North American Trailer Manufacturers Industry Report

- Americans prepare to get back to their spending ways